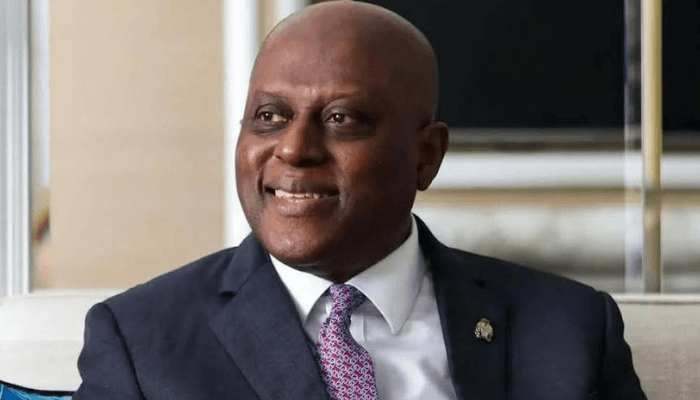

Olayemi Cardoso, the governor of the Central Bank of Nigeria, claims that after two years of extensive monetary changes, Nigeria’s economy is clearly improving and has entered a more stable phase.

Cardoso said that Nigeria has “turned a decisive corner” in its reform journey while speaking to bankers and financial leaders in Lagos at the 60th Annual Bankers Dinner of the Chartered Institute of Bankers of Nigeria.

He claimed that a stable foreign exchange market, declining inflation, and increased investor confidence all indicate that the economy is returning to equilibrium.

The Governor claims that distortions that have long plagued the economy are being gradually corrected by the Bank’s adoption of conventional monetary policy and stricter regulatory scrutiny.

By October 2025, inflation has fallen to 16.05 percent from 34.6 percent in November 2024. Additionally, food inflation has decreased to 13.12 percent from nearly 22 percent earlier in the year. Cardoso stated that in order to steer inflation toward single-digit levels, the CBN will keep modifying its policy tools.

He devoted a significant portion of his review to changes in the foreign exchange market. Cardoso affirmed that the CBN had paid off the multibillion-dollar foreign exchange backlog that the current administration inherited. The amount was originally thought to be above seven billion dollars. He pointed out that international airlines, manufacturers, and portfolio investors now feel more confident once the arrears were paid.

He credited changes like the Nigerian FX Market Conduct Code, the Electronic Foreign Exchange Management System, and the unification of exchange rates for the return of stability.

According to Cardoso, these actions have decreased opacity, deterred arbitrage, and made it possible for the naira to trade in a narrower range. Compared to the time when it extended above 60%, the margin between official and parallel market rates has recently dropped to less than 2%.

Investor inflows, which totaled 20.98 billion dollars in the first ten months of 2025—a 70% increase over the entirety of 2024—were also boosted by improved stability.

Cardoso emphasized a recovery in Nigeria’s foreign reserves, which have more than ten months’ worth of import cover and are currently at 46.7 billion dollars, the highest level in nearly seven years. He emphasized that rather than new borrowing, reserves are increasing due to greater diaspora remittances, non-oil exports, and stronger foreign exchange liquidity.

Regarding the state of the financial system, he stated that bank recapitalization is going well. Before the deadline of March 31, 2026, sixteen institutions have either reached or exceeded the new capital thresholds, while twenty-seven banks have already raised new funds.

This year’s stress tests, he continued, show that the financial system is still generally sound. Additionally, the Bank has finished a thorough examination of the cash distribution network, updated regulations for branch closures, and tightened control of ATMs and POS agents.

One noteworthy accomplishment, according to Cardoso, is Nigeria’s removal from the Financial Action Task Force grey list. He clarified that nations on the list frequently experience a 7.6% decline in capital inflows in the first year. He said that Nigeria’s departure has increased international trust in the nation’s financial practices and reduced compliance pressure on correspondent banks.

Additionally, he highlighted the fintech industry’s and digital payments’ explosive rise. Over 40 innovators are currently housed in the regulatory sandbox, over 12 million contactless cards have been issued, and switching businesses’ interoperability has improved. According to Cardoso, the CBN will keep promoting innovation as long as it does so within a framework that protects consumers and financial stability.

The governor said that international rating agencies have started to recognize Nigeria’s progress in reform. Nigeria was recently upgraded by Fitch from B- to B with a stable outlook, Moody’s from Caa1 to B3, and S&P from stable to positive.

Cardoso listed a number of top priorities for 2026, including bolstering banks’ resilience, enhancing oversight of fintech operators, expanding the digital payments network, improving price stability through a refined inflation-targeting framework, modernizing internal CBN procedures, and forging closer ties both domestically and internationally.

He concluded his speech optimistically, stating that Nigeria is now better equipped to withstand external shocks because to a flexible exchange-rate policy, increased non-oil exports, a developing services sector, and stronger reserves.