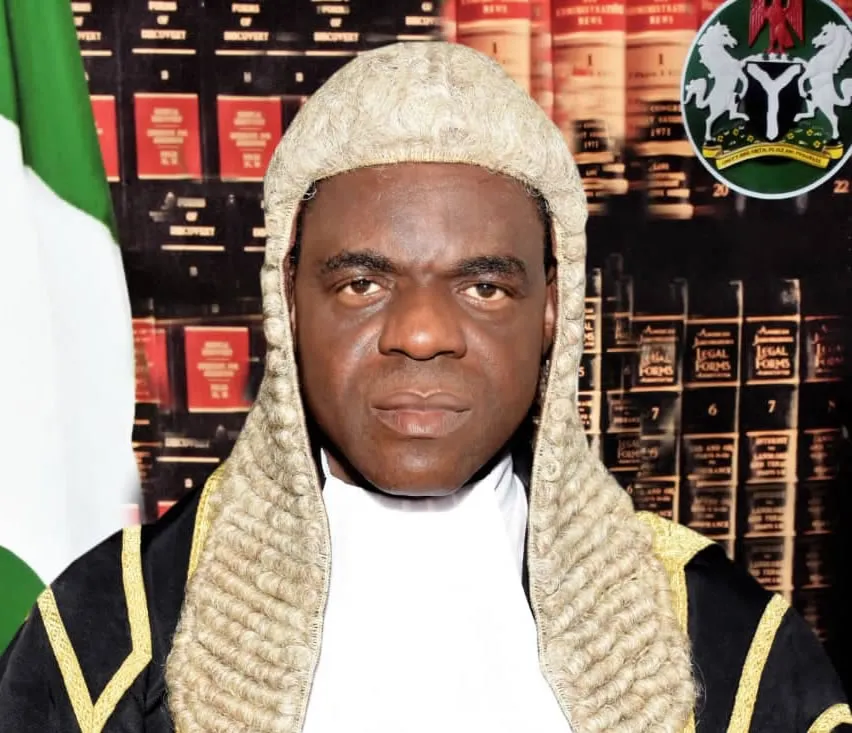

The extensive orders issued by Justice Dehinde Dipeolu of the Federal High Court, Lagos, which froze the bank accounts, shares, and assets of Nestoil Limited and its affiliates in a high-stakes debt recovery suit involving unverified claims exceeding $1.01 billion and N430 billion, have sparked new controversy.

Judge Dipeolu issued broad orders prohibiting Nestoil Limited, Neconde Energy Limited, and other Nestoil affiliates from using their bank accounts or interacting with money, shares, or assets held in any Nigerian financial institution in a decision on an ex parte motion dated October 15, 2025, and filed on October 20.

Neconde Energy Limited is at the center of the controversy. It has criticized its inclusion in the Mareva and receivership orders that FBNQuest Merchant Bank Limited and First Trustees Limited acquired, calling them unjust, repressive, and an obvious instance of judicial overreach.

In the meantime, petitions to be joined as defendants to reverse the broad ex parte court orders have been made by Glencore Energy UK Limited, Fidelity Bank Plc, Mauritius Commercial Bank Limited, and the Africa Finance Corporation (AFC), collectively referred to as Senior Lenders.

The Senior Lenders claimed that the ex parte orders of October 22, 2025, threatened their security interests in Neconde’s assets and operations, thus they sought the Court to set aside or modify them through their attorney, Olufemi Oyewole (SAN).

They contended that Neconde received a $640 million syndicated loan under the terms of the Senior Secured Medium-Term Facility Agreement dated April 27, 2016, which the plaintiffs neglected to include in their evidence.

They further stated that the Deed of Charge dated December 8, 2022, which the plaintiffs used to get the ex parte orders, was defective and unenforceable against Neconde because it was only registered against Nestoil Limited and not Neconde Energy Limited.

They stated that FBNQuest’s charge “shall rank in all aspects subordinate and subject to the charges and assignments constituted by the Neconde Senior Security Documents,” citing Clause 3.4 of the Deed of Charge.

In order to prevent future interference with Neconde’s assets while the main suit is being decided, they sought the Court to remove or modify the interim orders.

They claimed that Neconde is unable to fulfill its obligations to the Senior Lenders due to the interim orders, which could result in default events and insolvency actions with extremely disruptive outcomes.

When the matter was heard on Friday, November 7, 2025, Justice Dipeolu disclosed that he had received the petition against his handling of the case and related cases that had been forwarded to the Chief Judge of the Federal High Court.

After that, he halted the proceedings until the Chief Judge gave him the go-ahead to either continue or recuse himself.

In two related cases, FBNQuest Merchant Bank & Anor v. Nestoil Ltd & Ors (FHC/L/CS/2127/2025) and Aries Energy v. Neconde Energy & Ors (FHC/L/CP/1439/2025), the petitions accused the judge of judicial misconduct and careless issue of broad ex parte Mareva rulings.

The petitioners claimed that without confirming the ownership of a number of buildings, including Nestoil Tower, which are purportedly owned by other parties not owed to the plaintiffs, Justice Dipeolu issued freezing and receivership orders.

Additionally, they claimed that he violated the preservative nature of interim injunctions by granting freezing and receivership orders against Neconde without any justification and by giving the Nigerian Navy and Department of State Services (DSS) permission to help a receiver enforce civil orders and sell crude oil from OML 42.

To maintain public trust in judicial impartiality, they called on the National Judicial Council to look into the situation and the Chief Judge of the Federal High Court to transfer all relevant cases to a different judge.

Additionally, Neconde has filed court documents requesting that the ex parte orders be discharged.

In Suit No. FHC/CP/1439/2025: Aries Energy & Petroleum Company Limited v. Neconde Energy Limited, Gobowen Exploration and Production Limited, Dr. Ernest Azudialu, and Bridge H&T Limited, it contended that the current lawsuit is jurisdictionally incompetent because it was filed against it while it was undergoing winding-up proceedings before the Federal High Court, Lagos.

The firm argued that, in accordance with the provisions of the Companies and Allied Matters Act (CAMA) 2020, any disposition of a company’s property, including things in action, share transfers, or changes to members’ status after the winding-up process has begun, will be null and void unless the Court orders otherwise.

They additionally argued that, absent a court order, any attachment, sequestration, distress, or execution imposed against the estate of a firm in liquidation would likewise be illegal.

Find out more about newspapers

Neconde, a significant independent oil producer in OML 42, insisted that it had no knowledge of the syndicated loan arrangement that served as the basis for the lawsuit and was not owed to the plaintiffs.

The company’s attorneys contended that its inclusion essentially stopped its daily production of more than 40,000 barrels of crude oil and amounted to improper interference with third-party rights.

Given that Neconde is already the focus of ongoing winding-up proceedings before the same Federal High Court, they argued that the ex parte orders were unduly broad and issued without jurisdiction.

Nestoil and its affiliates, the other defendants, have also filed a move to vacate the orders, claiming that they were acquired by suppressing material information and are unlawful.

They accused the plaintiffs of deceiving the court into issuing unusual, far-reaching orders without consulting the impacted parties by neglecting to provide complete and honest disclosure prior to obtaining the ex parte orders.

In contrast to established legal norms regulating ex parte reliefs, which are meant to be temporary and preservative, the plaintiffs’ actions were “profoundly hasty and desperate,” according to their lawyer.

They contended that since the purported loans had been reorganized under a Common Terms Agreement (CTA) signed in December 2022, there was no need to freeze accounts or seize assets.

They claimed that because the CTA rescheduled repayments over a ten-year period beginning in December 2021, the current lawsuit is premature and violates its reconciliation clause.

Find out more about newspapers

The defendants insisted that only a forensic reconciliation could ascertain the true financial condition and further accused FBNQuest of neglecting to submit statements of account for more than three years in spite of numerous written demands.

They said that Nestoil Towers, a significant landmark on Akin Adesola Street, Victoria Island, is an immovable and secure property, negating the need for the severe order, and they claimed that the plaintiffs’ claims were exaggerated with unlawful and disproportionate costs.

Additionally, they contested the plaintiffs’ appointment of a receiver/manager, arguing that the nominee had not registered with the Corporate Affairs Commission (CAC) as required by CAMA 2020.

The companies cautioned that if the orders were upheld, operations would be paralyzed, directors’ personal accounts would be frozen, and Neconde’s oil output would suffer catastrophic losses that would also have an impact on the Federal Government’s earnings from crude oil exports.

Industry sources cautioned that if the ongoing legal dispute is not settled quickly, oil production in OML 42, which used to produce more than 250,000 barrels per day in the 1970s, may be disrupted, further undermining investor confidence in Nigeria’s domestic oil industry.